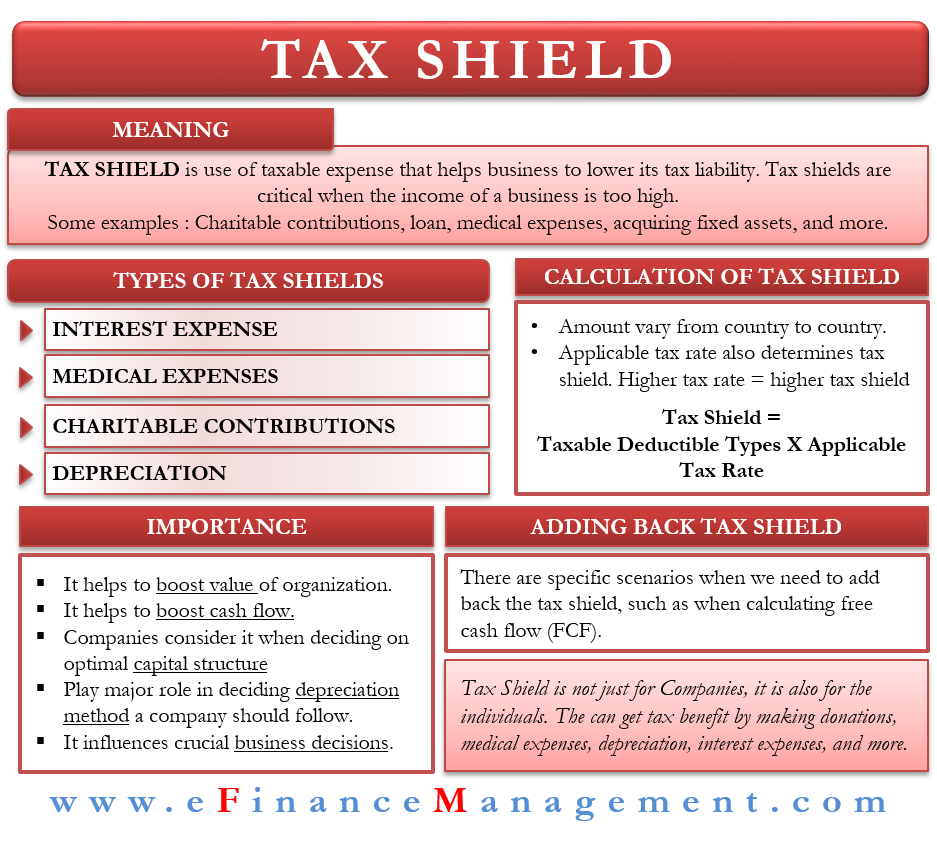

tax shield formula for depreciation

There is a Formula for using the Depreciation Tax Shield. Cash Outflow in Year 1 Annual repayment Depreciation tax shield Interest tax shield.

Tax Shield Formula Step By Step Calculation With Examples

Calculating the tax shield can be simplified by using this formula.

. The use of a depreciation tax shield is most applicable in asset-intensive industries where there are large amounts of fixed assets that can be depreciated. Google company has an annual depreciation of 10000 and the rate of tax is set at 20 the tax savings for the period is 2000. Operating Profit 700000 100000 20000.

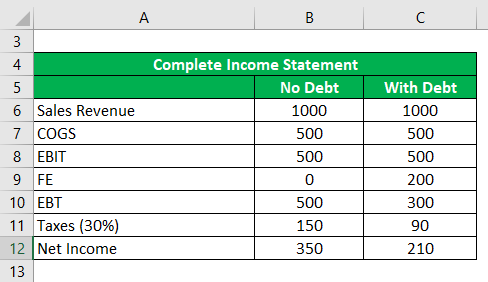

Lets imagine that the entire Business is worth 1000 Enterprise Value before the Tax Shield. Click to see full answer. Interest Tax Shield Example.

The term Tax Shield is derived from the ability of the deductions to shield the taxpayers income from taxation. Tax Shield Value of Tax-Deductible Expense x Tax Rate. Depreciation Tax Shield is calculated as.

The formula for calculating a depreciation tax shield is easy. It displays how much you deducted. The maximum depreciation expense it can write off this year is 25000.

Basically the company uses two main tax shield strategies. It is because 400 has already been saved or there is 400 less cash flow due to the tax shield. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give you 3500.

It also has an option to write off only a minimum amount of 2700. If we do not convert the bond the tax savings would be 400. The tax rate of Marshal company is 30.

2005204219 is your Tax Depreciation Schedule providing the Astute Property Investor a means to create simple accurate and affordable Tax Depreciation Schedules for Property Allowance. Calculate annual tax savings from depreciation tax shield. The tax shield formula is simple.

Operating Profit Profit Depreciation Depreciation Tax Shield. The result equals the depreciation tax shield as the company will pay lower taxes. In short the Net Present Value of the Depreciation Tax Shield is 5 lower with the Sum-of-Years-Digits approach.

To learn more launch our free accounting and finance courses Free Courses. Conversely the lower your depreciation expense the lower your tax shield. The higher your depreciation expense the higher your tax shield.

Depreciation tax shield Depreciation expense x tax rate. Tax rate 40 The first two columns of Taxable income with Depreciation. When the Depreciation Tax Shield is Most Effective.

In conjunction with the formula average debt cost of debt and tax rate are used. Operating Profit is calculated as. Depreciation Tax Shield 20000.

Depreciation Tax Shield Formula. The tax shield Johnson Industries Inc. The depreciation tax shield helps the company to maintain all the depreciation of the assets.

This is usually the deduction multiplied by the tax rate. People also ask how does debt provide a tax shield. August 5 2020 by kumara Liyanage.

Depreciation Tax Shield Depreciation Applicable Tax Rate. Operating Profit 620000. You calculate depreciation tax shield by taking 100000 X 20 20000.

But if we avail the option to convert the bond the net value of lost tax shield is 2000 1 20 1600. A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. This gives you 750 in.

The annual depreciation would be computed first and then multiplied by 30 or 030 to find the annual tax savings from depreciation tax shield. Thus a tax shield is an amount by which the depreciation and amortization or any non-cash charge lower your income subject to taxation creating cash savings. 12063 30000 333 35 30000 10 35 7513.

Depreciation tax shield formula. Tax Shield Deductions x Tax Rate. A depreciation tax shield is a tax evaded causing by the deduction of depreciation in assets.

Will receive as a result of a reduction in its income would equal 25000 multiplied by 37 or 9250. The calculation of depreciation tax shield can be obtained by depreciation expense and tax rate as shown below. Annual depreciation 420000 6 years 70000 21000.

Depreciation Tax Shield Sum of Depreciation expense Tax rate. Analyzing the Tax Shield Formula calculates the Amount of Tax Deductible Expenses per Deduction per the Tax Shield Formula sum of Tax-Deductible Expenses Tax rate. Depreciation Tax Shield 100000 20.

Multiply your tax rate by the deductible expense to calculate the size of your tax shield. For example Below we have two segments. The amount by which depreciation shields the taxpayer from income taxes is the applicable tax rate multiplied by the amount of depreciation.

The formula to compute for the Tax Shield is. Tax Shield Sum of Tax-Deductible Expenses Tax rate. Cash outflow in year 2 12063 30000 333 35 30000 12063 3000 10 35.

For example suppose you can depreciate the 30000 backhoe by 1500 a year for 20 years. The impact of adding removing a tax shield is highly impacted by the companys optimal capital structure which is a mix of debt and equity fundingMoreover the interest expense on the debt is tax deductible which makes the. Tax Shield Deduction x Tax Rate.

Depreciation Tax Shield Formula Depreciation expense Tax rate. Therefore the company can achieve a tax shield of 20000 by leveraging its depreciation expenses. Applicable tax rate is 21 and the amount of depreciation that can be deducted is 100000 then the depreciation tax shield.

It can vary from country to country and will depend on the tax rate of the taxpayer higher rate means higher deductions and what deductibles are considered as eligible or not. We can analyze the taxable income with the assistance of multiplication of tax rate with reduction expense. Depreciation Tax Shield Formula Depreciation tax shield Tax Rate x Depreciation Expense You are free to use this image on your website templates etc Please provide us with an attribution link How to Provide Attribution.

The applicable tax rate is 37. So the Business could be worth 5 more or less depending on the approach it chooses. All you need to do is multiply depreciation expense for tax purposes not financial purposes and multiply by the effective income tax rate.

December 13 2021. The effect of a tax shield can be determined using a formula.

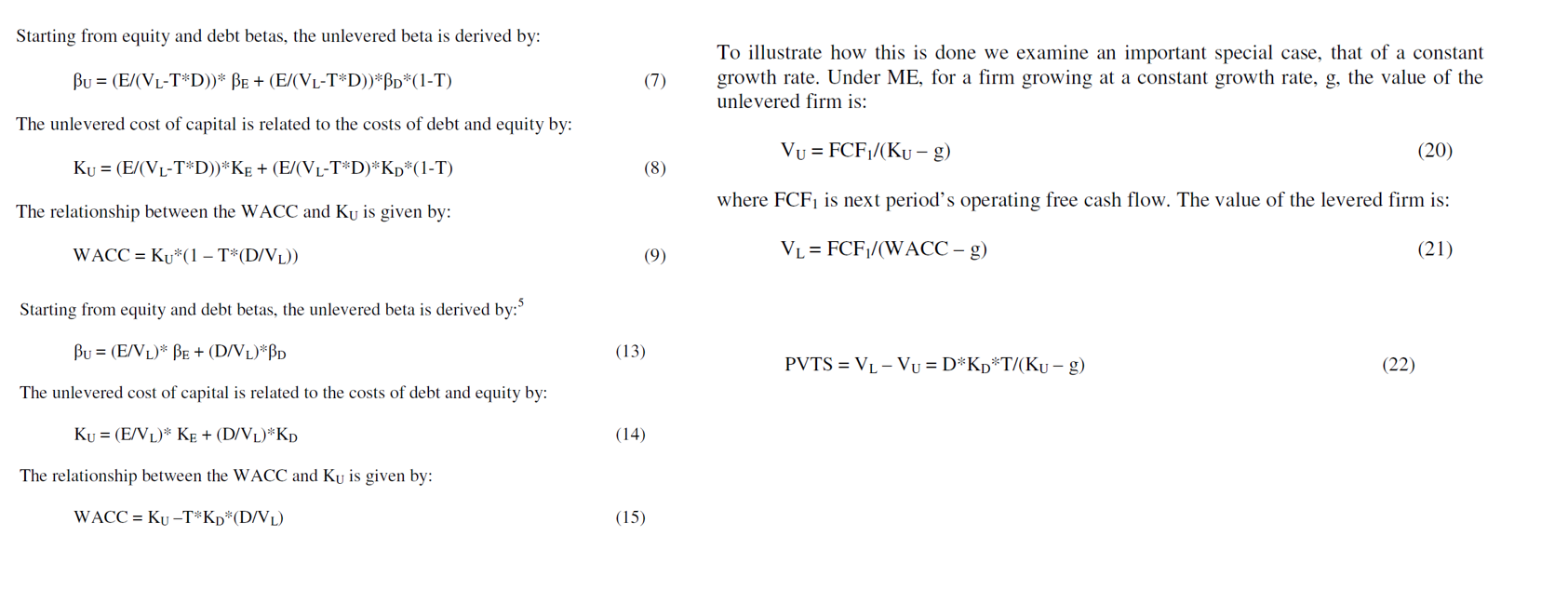

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shields Financial Expenses And Losses Carried Forward

Tax Shield Formula Step By Step Calculation With Examples

What Is A Depreciation Tax Shield Universal Cpa Review

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Docsity

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

What Is A Tax Shield Depreciation Tax Shield Youtube

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Calculator Calculator Academy

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula How To Calculate Tax Shield With Example